Top: Teacher Rox reading the storybook to her students before they begin playing the game.

Bottom: Ena of WOH explaining the card details to the kids.

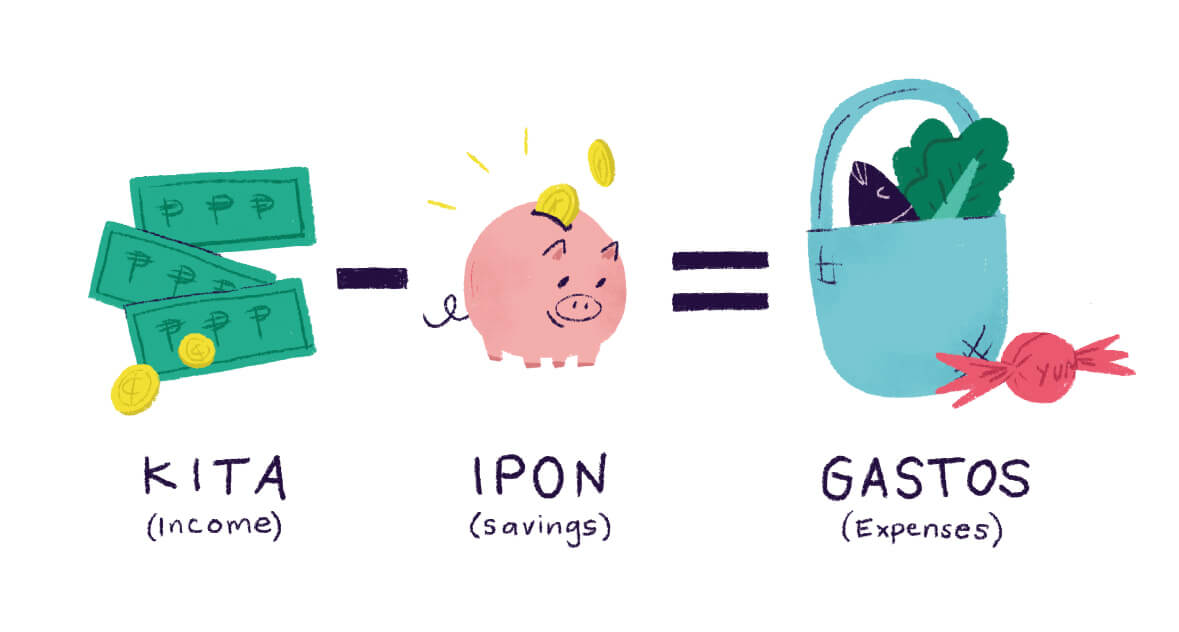

Financial literacy, the knowledge of basic finance concepts such as goal-setting, budgeting, and saving, has only recently been integrated into the general education curriculum of the Philippines. That is unfortunate, especially given the continuous struggle for resources and financial stability in the country. Some of us start learning the intricacies of finance only by the time we get our first job and start earning for ourselves. It's not a stretch to say that this financial awareness—literacy, even—deserves a spot at an earlier time in our lives.

Taking context into account

The common assumption is that children are too young to talk about money matters. Money can be a potentially sensitive issue, and when it is addressed improperly, it can lead to difficult misunderstandings. That does not mean, however, that the topic is strictly off-limits. Instead, it only highlights the all-important role of teachers and facilitators—there must be a way to talk about money in a way that is both conducive and encouraging to children.

The market matters

Difficult topics call for dynamic teaching strategies. In our conversations with public school teachers and financial literacy advocates, it became apparent that we were all in the position to adjust to our students. We started with an idea for an activity-based game kit for elementary students, and though it was promising, it needed refinement. More importantly, it needed constant testing with the community we wanted to reach.

there must be a way to talk about money in a way that is both conducive and encouraging to children.

We held consultations with other game designers and exchanged ideas with teachers who held expertise in handling elementary grade levels. We held initial test runs and discovered hurdles that we would not have seen otherwise. It was very productive—after all, we all wanted to bring financial literacy to a level where it can be seen, not just as a special or extracurricular topic, but as one that is intertwined with the core principles of basic education.

Learning to play, playing to learn

Pitaka Ko, the result of that arduous process, is a role-playing game that facilitates financial literacy allowing students to make decisions through the use of paper wallets, play money, journals, and game cards all in one kit for teachers to use in their classroom.

The game will unfold and allow the students to experience the freedoms and responsibilities of handling money. Will you buy the shiny new ruler you saw at the store? Will you buy food for a friend in need? All throughout, we wanted the children to have the power to decide, with their teachers helping them understand the larger financial implications.

The teacher will facilitate the whole game in a span of four weeks with the goal of earning as much FinLit Points that they can. Finlit points represent good financial decisions made, that will depend on the action cards drawn each week. The basic concepts and gameplay is explained by the teacher at the start with the use of a storybook.

The game can be played individually with a maximum of 15 players. To manage big classrooms with around 50 to 60 students, the students will be grouped together with specific roles assigned to them monitored through a Tracker. Each role entails a specific responsibility that will rotate among the students in the group.

Every week, with the roles assigned, the students will be given an allowance to pay for a Layunin (Goal) card.

The challenging part and point of discernment will happen when they are asked to draw a Desisyon card which tempts them to buy items different from their Layunin (Goal). There will be moments when they have extra money the way the game is designed, so that gives them reason to purchase Desisyon cards.

Students picking a Layunin Card for the week.

At the end of that week, they will have to roll the Senaryo card, which is based purely on chance of either gaining or losing money. Losing money is framed as “a rainy day,” hoping to teach them that they should always save so that if there is an emergency, they have enough to pay for it.

This happens every week, and the teacher as the banker facilitates and manages the payments and release of allowance. The students will each have a Savings journal that allows them to track the money they earn and spend every week.

At the end of four weeks, based on the decisions they've made, they will count the FinLit points based on the cards they've kept. The player or group with the most cards and FinLit points will win, since it means they've made good financial decisions all throughout the week.

Early investments

Though the causes of economic strain stretch far beyond any individual's responsibilities, it is important to acknowledge that practicing proper judgment with personal finances matters. Financial literacy, even at a young age, is a necessary step towards a more financially inclusive community.

ACKNOWLEDGEMENTS

Sunlife FoundationThe Spark Project

Balangay Entertainment

Department of Education

Gusa Elementary School

Parang Mangga & Dizon Elementary School